Unemployment Insurance: Understanding Financial Support for Job Loss

"Unemployment insurance is a safety net designed to help people who are temporarily out of work due to no fault of their own." - Elizabeth Warren

Brief Insight

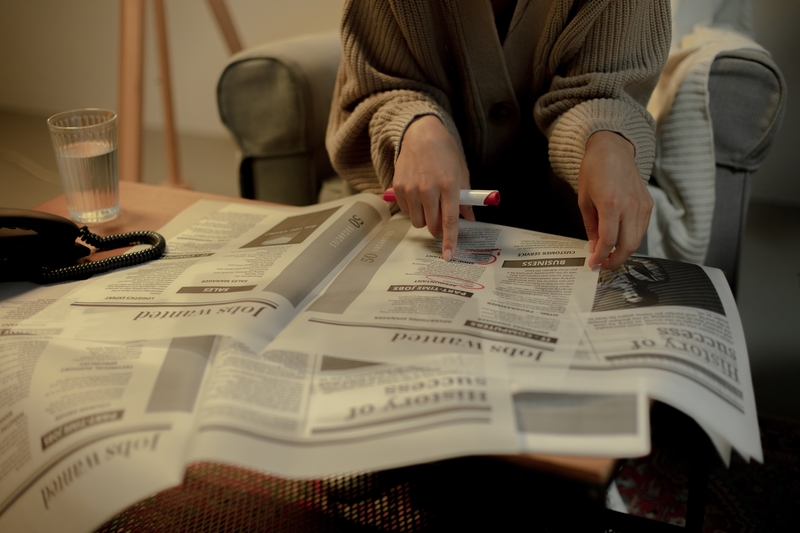

Unemployment Insurance is a government-provided benefit that provides financial support to individuals who have lost their jobs through no fault of their own. It is intended to provide temporary assistance while the individual seeks new employment. Eligibility for unemployment insurance varies by state and is based on factors such as work history, the reason for job loss, and availability and willingness to work.

PHOTO: clsphila.org

The Basics of Unemployment Insurance: Providing Financial Security During Unemployment

Unemployment Insurance (UI) is a government program designed to provide temporary financial assistance to individuals who have lost their jobs due to no fault of their own. The program is administered by the state governments in the United States, but it is funded jointly by the federal government and the states.

UI is intended to provide support to workers during periods of unemployment while they search for new employment opportunities. Eligible workers can receive weekly payments for a limited time, typically up to 26 weeks in most states, although some states have extended benefits during times of high unemployment.

To qualify for UI, individuals must have been employed for a certain length of time and have earned a minimum amount of wages, which varies by state. Additionally, individuals must have lost their job through no fault of their own, such as due to a layoff or business closure. Workers who quit their jobs or are fired for misconduct are generally not eligible for UI.

In order to receive UI benefits, individuals must file a claim with their state's unemployment insurance program. This can typically be done online or by phone and requires the individual to provide information about their work history, the reason for job loss, and other relevant details. Once the claim is approved, individuals will receive weekly payments as long as they continue to meet the eligibility requirements, such as actively seeking new employment and being available to work.

UI benefits are calculated based on the individual's previous earnings, with the weekly benefit amount varying by state and the individual's income history. In some states, individuals may also be eligible for additional benefits, such as job training or assistance with the job search.

During times of economic recession or high unemployment rates, the federal government may also provide additional funding to states to extend UI benefits or provide emergency unemployment assistance. For example, during the COVID-19 pandemic, the federal government passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which provided additional funding for UI and extended benefits to self-employed and gig workers who were not traditionally eligible for UI.

Overall, Unemployment Insurance is an important safety net program that provides temporary financial assistance to workers who have lost their jobs through no fault of their own. It helps individuals maintain their financial stability while they search for new employment opportunities and can play a critical role in mitigating the impact of economic downturns.

Statistics

As of December 2021, the average weekly benefit amount for unemployment insurance in the United States was $362.

In 2020, the highest insured unemployment rates (IUR) were seen in Hawaii, Nevada, and Puerto Rico.

The Evolution of Unemployment Insurance: From Great Depression to Present Day

The origins of UI can be traced back to the Great Depression of the 1930s when high levels of unemployment prompted the federal government to take action to provide assistance to jobless workers.

In 1935, the Social Security Act was signed into law by President Franklin D. Roosevelt, creating a broad range of social welfare programs, including UI. The goal of UI was to provide a basic level of financial support to workers who had lost their jobs due to economic conditions, while also incentivizing them to actively seek new employment opportunities.

Under the Social Security Act, states were given the option to establish their own UI programs, with federal oversight and funding. By 1937, all states had enacted UI programs, and the federal government began providing grants to states to help fund their programs. Over time, the federal government has also played a larger role in setting standards for UI eligibility, benefits, and administration.

Since its creation, UI has undergone a number of changes and adaptations to meet the needs of workers and changing economic conditions. For example, during times of economic recession or high unemployment, the federal government may provide additional funding to states to extend UI benefits or provide emergency unemployment assistance.

Today, UI remains an important social safety net program that provides temporary financial assistance to workers who have lost their jobs due to economic conditions. It helps individuals maintain their financial stability while they search for new employment opportunities and can play a critical role in mitigating the impact of economic downturns.

PHOTO: https://www.pexels.com/uk-ua/@energepic-com-27411/

The Funding of Unemployment Insurance: Sources and Methods

Unemployment Insurance (UI) is funded by a combination of federal and state resources. Under the federal-state partnership, the federal government sets broad guidelines for UI programs, but states have significant flexibility in determining their own eligibility criteria, benefit levels, and administrative procedures.

Employers are typically responsible for paying into the UI system through payroll taxes. Each state sets its own tax rate, based on factors such as the number of employees and the employer's industry. Employers are required to pay taxes on a portion of each employee's wages, up to a certain maximum amount. The money collected from these taxes goes into a state's UI trust fund, which is used to pay out benefits to eligible workers.

In addition to payroll taxes, the federal government provides funding to states to help cover the costs of administering their UI programs. The federal government also provides additional funding to states during times of high unemployment or economic recession to extend UI benefits or provide emergency unemployment assistance.

During the COVID-19 pandemic, the federal government provided significant additional funding to states to support their UI programs. This included the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which provided funding for additional weeks of UI benefits, expanded eligibility criteria, and a temporary $600 weekly boost to benefit amounts. The American Rescue Plan Act of 2021 also provided additional funding for UI programs, including a $300 weekly boost to benefit amounts and an extension of pandemic-related benefits through September 2021.

Overall, UI is primarily funded through employer payroll taxes, with additional federal funding provided to support state UI programs during times of economic downturn or crisis.

Interesting Facts

The first state-level unemployment compensation program was enacted in Wisconsin in 1932, during the Great Depression.

The federal government established the Unemployment Insurance (UI) program in 1935 as part of the Social Security Act.

Administration of Unemployment Insurance: How it Works

Unemployment Insurance (UI) is administered at the state level, with each state responsible for setting its own eligibility criteria, benefit amounts, and administrative procedures. This means that the specific details of how UI is administered can vary significantly from state to state.

In general, workers who become unemployed through no fault of their own may be eligible to receive UI benefits. To qualify for benefits, workers must meet certain requirements, such as having earned a minimum amount of wages over a specified time period and being actively engaged in seeking new employment.

Workers typically must file a claim for UI benefits with their state's workforce agency or other designated agency. The agency will review the worker's claim and determine whether they meet the eligibility criteria for benefits. If approved, the worker will receive a weekly benefit amount, typically for a limited number of weeks.

To continue receiving benefits, workers must regularly certify that they remain unemployed and are actively seeking new employment. They may also be required to participate in job training or other employment-related programs.

UI benefits are paid out of a state's UI trust fund, which is funded through employer payroll taxes. In general, the more workers a company employs and the more wages they pay, the higher their UI tax rate will be. Employers may also be subject to additional taxes or penalties if they lay off large numbers of workers or if their former employees' file for UI benefits.

During times of economic downturn or crisis, the federal government may provide additional funding to states to help cover the costs of administering UI benefits or to extend the duration of benefits. This was the case during the COVID-19 pandemic when the federal government provided significant additional funding to states to support their UI programs and expand eligibility criteria and benefit amounts.

Overall, UI is administered by state workforce agencies and funded through employer payroll taxes, with additional federal funding provided during times of economic crisis. The specific details of how UI is administered can vary significantly from state to state.

PHOTO: https://www.pexels.com/uk-ua/@ron-lach/

Services Offered by Unemployment Insurance: A Short Guide

Unemployment Insurance (UI) provides temporary financial assistance to individuals who have lost their jobs through no fault of their own and are actively seeking employment. The services provided by UI vary by state but generally include

- Weekly cash payments: Eligible individuals receive weekly payments to help cover their basic expenses while they are unemployed. The amount of the payment and the duration of benefits vary by state.

- Job search assistance: Many states offer job search assistance to help UI recipients find employment. This can include access to job listings, job fairs, and other resources.

- Education and training: Some states offer education and training programs to help UI recipients gain new skills and qualifications that can improve their chances of finding employment.

- Counseling and support: UI recipients may be eligible for counseling and support services to help them cope with the stress and uncertainty of unemployment.

- Other benefits: Some states offer additional benefits to UI recipients, such as access to health care, child care assistance, and other support services.

Overall, the goal of UI is to provide a temporary safety net for individuals who have lost their jobs and are actively seeking new employment. By providing financial assistance and other services, UI can help individuals maintain their basic needs and improve their chances of finding new employment.

Statistics

During the COVID-19 pandemic, there were more than 80 million initial claims for unemployment insurance in the United States.

According to the Bureau of Labor Statistics, the unemployment rate in the United States was 4.2% in December 2021, down from a high of 14.8% in April 2020.

Understanding Eligibility Requirements for Unemployment Insurance

Eligibility for Unemployment Insurance (UI) varies by state, but there are certain general requirements that must be met in order to qualify for benefits. These requirements include

- Employment status: In general, individuals must have been employed for a certain amount of time and have lost their job through no fault of their own. This typically means that they were laid off, their employer went out of business, or they were fired for reasons other than misconduct.

- Earnings requirements: Most states have earnings requirements that must be met in order to qualify for UI. This usually means that the individual must have earned a certain amount of wages during a specific period of time prior to losing their job.

- Availability and willingness to work: UI recipients must be able and willing to work and actively seek new employment. They must be available to accept any suitable job offers that come their way.

- Registration with state workforce agency: In many states, individuals must register with the state workforce agency and be actively seeking new employment in order to qualify for UI.

- Other eligibility criteria: Some states have additional eligibility criteria, such as being a U.S. citizen or having valid work authorization.

It is important to note that eligibility for UI is determined on a case-by-case basis, and meeting the basic requirements listed above does not guarantee that an individual will qualify for benefits. Each state has its own specific rules and regulations regarding UI eligibility and benefit amounts, so it is important to consult the state's UI agency for more information.

PHOTO: https://www.pexels.com/uk-ua/@ron-lach/

The Benefits of Unemployment Insurance: Financial Stability During Unemployment

Unemployment Insurance (UI) provides temporary financial assistance to workers who have lost their jobs through no fault of their own. The benefits of UI include

- Financial support: Unemployment Insurance provides temporary financial support to those who have lost their job, helping them to pay bills and meet their basic needs while they look for new employment.

- Job search assistance: Unemployment Insurance programs often offer job search assistance, such as training programs, career counseling, and job placement services, which can help recipients find new employment quickly.

- Reduced stress: Losing a job can be a stressful and difficult experience, but Unemployment Insurance can help ease the financial burden and reduce the stress associated with job loss.

- Social stability: Unemployment Insurance benefits help to maintain social stability by preventing widespread economic hardship and reducing the need for public assistance programs.

- Economic stimulus: Unemployment Insurance benefits can act as an economic stimulus by increasing consumer spending, which can boost the economy.

- Incentive to work: Unemployment Insurance benefits are designed to be temporary and provide an incentive for recipients to seek new employment, rather than relying on government assistance.

- Health insurance: In some cases, Unemployment Insurance benefits may also include health insurance coverage, which can be critical for those who have lost their job and their health insurance benefits.

Overall, Unemployment Insurance is an important safety net for workers who have lost their jobs through no fault of their own, providing temporary financial assistance and job search support to help them get back on their feet.

Interesting Facts

In 2020, the COVID-19 pandemic caused an unprecedented surge in UI claims in the United States, with over 40 million claims filed in the first ten weeks of the pandemic.

The highest UI benefit amounts are typically found in Massachusetts, while the lowest are in Mississippi.

Limitations and Drawbacks of Unemployment Insurance: What to Keep in Mind

While Unemployment Insurance provides many benefits, there are also some disadvantages and limitations to consider:

- Limited coverage: Not all workers are covered under the unemployment insurance program. For example, self-employed workers, freelancers, and independent contractors are not typically eligible for benefits.

- Duration of benefits: Unemployment insurance benefits are typically limited in duration, and may not be enough to cover all of a person's expenses while they search for new work. In addition, some states have been forced to reduce the length of time that people can receive benefits due to budget constraints.

- Administrative challenges: The process of applying for and receiving unemployment benefits can be complicated, and there may be delays or errors in processing claims. This can be frustrating for individuals who are already struggling financially.

- Stigma: There is still a stigma attached to receiving unemployment benefits, and some people may feel embarrassed or ashamed about their situation. This can make it difficult for them to seek the help they need.

- Funding challenges: Unemployment insurance is funded through taxes on employers, and if too many people are claiming benefits at the same time, it can strain the system and lead to financial difficulties for state governments.

Overall, while unemployment insurance can be a lifeline for those who have lost their jobs, it is not a perfect system and there are some limitations to consider.

PHOTO: https://unsplash.com/@neonbrand

Step-by-Step Guide to Applying for Unemployment Insurance

The process of applying for Unemployment Insurance (UI) can vary depending on the state in which you live. However, there are general steps you can follow to apply:

- Determine your eligibility: Before you apply for UI, you must determine if you are eligible. Eligibility requirements vary by state, but generally, you must have lost your job through no fault of your own, be actively seeking work, and meet other criteria. You can check your state's UI website or contact your state's workforce agency to find out if you are eligible.

- Gather required information: You will need to provide certain information when you apply for UI. This can include your Social Security number, proof of your previous employment and wages, and information about the reason you are no longer working. You may also need to provide additional documentation, such as a driver's license or state ID.

- File your claim: You can typically file your UI claim online, over the phone, or in person at your state's workforce agency. Some states may also allow you to file your claim through a mobile app. Follow the instructions provided by your state to submit your claim.

- Wait for approval: After you file your claim, it will be reviewed by your state's workforce agency. This process can take several weeks, during which time you may need to continue filing weekly or biweekly claims to receive benefits.

- Receive benefits: If your UI claim is approved, you will receive weekly or biweekly benefit payments. The amount of your benefits and the length of time you are eligible to receive them will depend on your state's UI program.

It is important to note that UI benefits are intended to provide temporary financial assistance while you search for new employment. If you are receiving UI benefits, you may be required to participate in job search activities and accept suitable job offers. Failure to comply with these requirements can result in a reduction or termination of your benefits.

Interesting facts

Certain workers, such as self-employed individuals and independent contractors, were historically not eligible for UI benefits, but recent legislation has expanded eligibility to include these workers in some cases.

- Unemployment Insurance is a government program that provides financial assistance to individuals who have lost their jobs due to no fault of their own.

- The program is funded through taxes paid by employers and is administered by state governments.

- Eligibility for Unemployment Insurance varies by state, but generally, individuals must have worked a certain number of weeks and earned a minimum amount of wage to qualify.

- The benefits provided by Unemployment Insurance can help individuals cover their basic living expenses while they search for a new job.

- However, the program has some limitations, including the fact that benefits are typically only available for a limited period of time and may not fully replace an individual's lost income.

- To apply for Unemployment Insurance, individuals should contact their state's unemployment office and follow the application process outlined by their state.

FAQ

How long can I receive Unemployment Insurance benefits?

The length of time varies depending on the state you live in and the unemployment rate at the time of your claim. Typically, the benefits can last up to 26 weeks, but some states have extended benefits for certain circumstances.

Can I receive Unemployment Insurance if I quit my job?

In general, you may not be eligible for Unemployment Insurance if you quit your job voluntarily. However, if you quit for a valid reason such as unsafe working conditions or discrimination, you may be eligible for benefits.

What happens if I am denied Unemployment Insurance?

If you are denied Unemployment Insurance, you have the right to appeal the decision. The process and timeline for appeals varies by state, so it's important to follow the instructions provided in your denial notice.

Can I work part-time while receiving Unemployment Insurance benefits?

It depends on the state you live in and the amount of income you earn from part-time work. In general, you may be able to work part-time and still receive partial Unemployment Insurance benefits, but you must report your earnings to the unemployment agency.

Do I have to pay taxes on Unemployment Insurance benefits?

Yes, Unemployment Insurance benefits are considered taxable income by the federal government and some states. You will receive a Form 1099-G at the end of the year to report your benefits on your tax return.